Subscribe to trusted local news

In a time of both misinformation and too much information, quality journalism is more crucial than ever. By subscribing, you can help us get the story right.

- Subscription costs less than £1 a week with an annual plan.

Already a subscriber? Log in here.

19

Jan 2022

Exclusive: Council invests £70m into climate-damaging fossil fuel companies

A North Yorkshire County Council-controlled pension fund invests millions into fossil fuel companies whilst the council promotes carbon reduction policies, the Stray Ferret can exclusively report.

Over the last two years, the council launched its "Beyond Carbon" plan that sets a target date of 2030 to reach net-zero neutrality.

It has also been instrumental in developing sustainable travel schemes in Harrogate such as the Otley Road Cycle Path, the Station Gateway and the Beech Grove Low Traffic Neighbourhood.

But away from the public gaze, the council is investing millions in fossil fuel companies with a pension funding policy that is directly at odds with its public messaging and sustainable transport plans.

What is a pension fund?

Staff from Harrogate Borough Council and 30 other district, city and town councils in the county pay into the North Yorkshire Pension Fund through their salary. The fund is administered by NYCC.

The council is legally obliged to invest cash from its pension fund after contributions have been collected and pensions have been paid.

It chooses to invest this into the stock market and its entire portfolio is worth over £2.7bn.

The Stray Ferret obtained a full list of the companies the pension fund invests in through a freedom of information request.

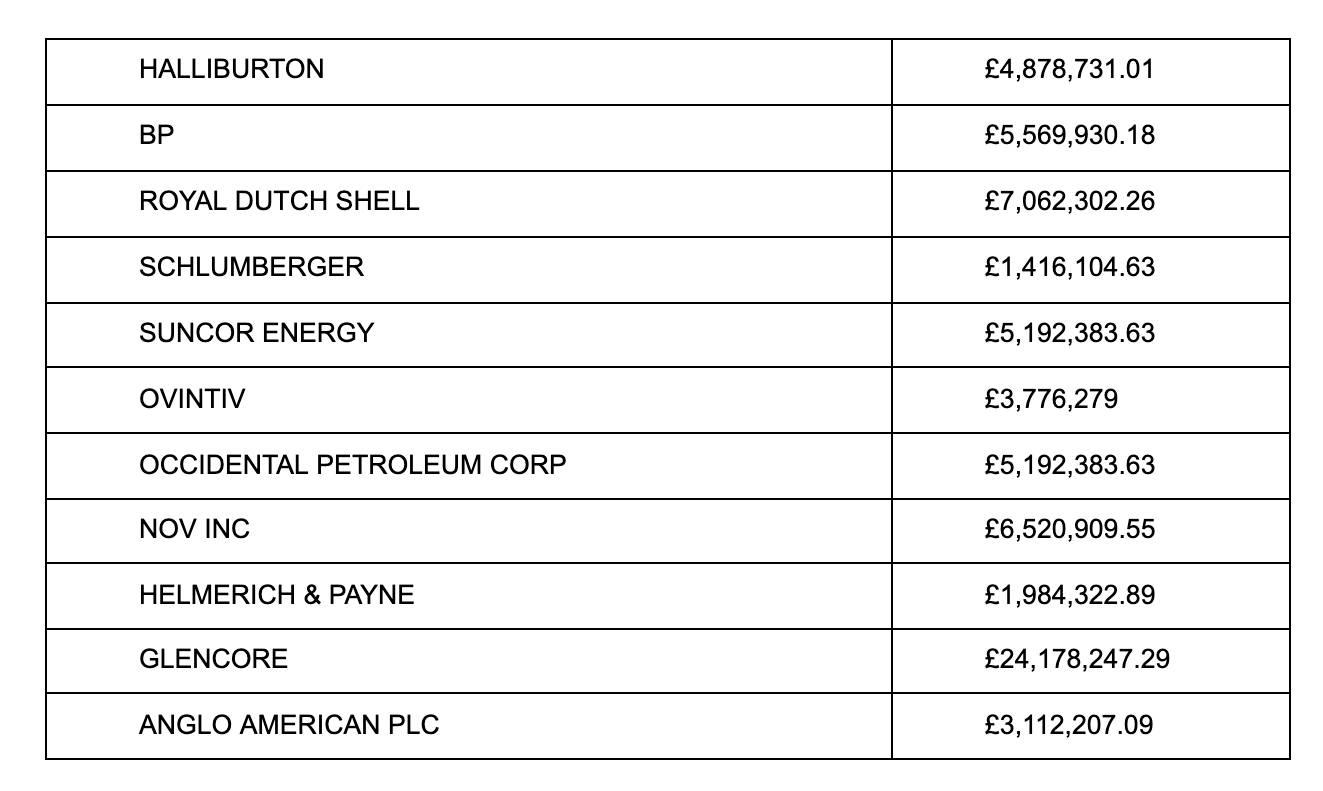

The fund has sizeable holdings in 11 fossil fuel companies

The fund has a sizeable £7m holding in oil firm Shell and £5.5m in BP, which Greenpeace has called "climate criminals" due to its contribution to climate change.

Investments also include £5m with Occidental Petroleum, which operates oil drilling rigs in the United States, Canada and Chile.

The investments mean thousands of council staff will have their retirements part-funded by the companies.

"Hypocritical"

Conservative county councillor Don Mackenzie is in charge of highways at the council and has been the public face of the various active travel schemes.

He has been quoted calling climate change a "global priority" and has repeatedly emphasised the need to move away from transport that is powered by fossil fuels.

But NYCC is now facing accusations of hypocrisy due to its massive investments into the very companies that it is trying to guide residents away from.

NYCC is behind the Beech Grove Low Traffic Neighbourhood

Andy Rickard, chair of Harrogate and District Green Party told the Stray Ferret he was "angry and frustrated" by the council's "hypocritical" investments. He called on NYCC to divest from fossil fuel companies immediately.

He said:

York Liberal Democrat councillor Christian Vassie is one of 11 councillors that sit on the North Yorkshire pension fund committee. He told the Stray Ferret that "we have to sort this out".

He said:

How the fund works

The pension fund is not managed directly by North Yorkshire County Council.

Instead, a private company called Border To Coast acts as the manager of the fund.

Government guidelines say council pension fund managers can take ethical, social or environmental concerns into account when it invests, providing the fund’s finances do not suffer.

However, the North Yorkshire Pension Fund's responsible investment policy, last updated in July 2021, clearly states that it will not implement an "exclusionary policy" against companies that damage the environment.

It says:

'Council must show courage'

Cllr Vassie joined the pension fund committee in July 2020. He also chairs York's climate change policy and scrutiny committee.

He said he has tried to steer the fund towards greener companies, but because the primary focus of the fund is to make money, he said the fund has to be presented with alternatives that will offer at least the same financial return.

York Liberal Democrat councillor Christian Vassie

A study published ahead of the COP26 climate summit in November suggested half of the world's fossil fuel investments could become worthless by the mid-2030s due to the transition towards net-zero.

Cllr Vassie said the pension fund needs to have "the courage of its convictions" to leave fossil fuel investments behind in favour of greener alternatives.

He warned if they don't, the council could be left lumbered with "stranded assets".

Addressing climate change

North Yorkshire is not alone in investing its pension fund into fossil fuels. Friends of the Earth says £10bn is invested in total by UK local authorities.

However, several councils, including Luton Borough Council and Southwark Council, have recently passed motions to set a firm date for its pension fund to divest from fossil fuels.

David Houlgate, Harrogate branch secretary at UNISON, the union that represents staff at Harrogate Borough Council and North Yorkshire County Council, told the Stray Ferret the union has asked the Pension Fund to divest from its investments in fossil fuels.

He said it must then secure suitable alternative investments that address climate change whilst protecting the value of the fund.

Mr Houlgate added:

Divest from fossil fuels

Cllr Vassie said he hopes North Yorkshire will divest from fossil fuels within the next five years, but the pension fund's own climate change policy stops well short of making any firm commitment to divest.

It says:

A BP oil drilling rig in the Gulf of Mexico. Credit - BP

For campaigners like Andrew Rickard from the Harrogate and District Green Party, progress is not coming quick enough.

He said there is "little evidence" to support the fund's claim that its "active engagement" has had any effect whatsoever on the way fossil fuel companies operate.

He added:

Council's response

Gary Fielding, Treasurer of North Yorkshire Pension Fund for North Yorkshire County Council, said:

Tomorrow, we reveal how the Pension Fund invests £15m in arms companies that have built weapons for the controversial Saudi Arabia-led bombing campaign in Yemen, killing thousands of civilians.

0