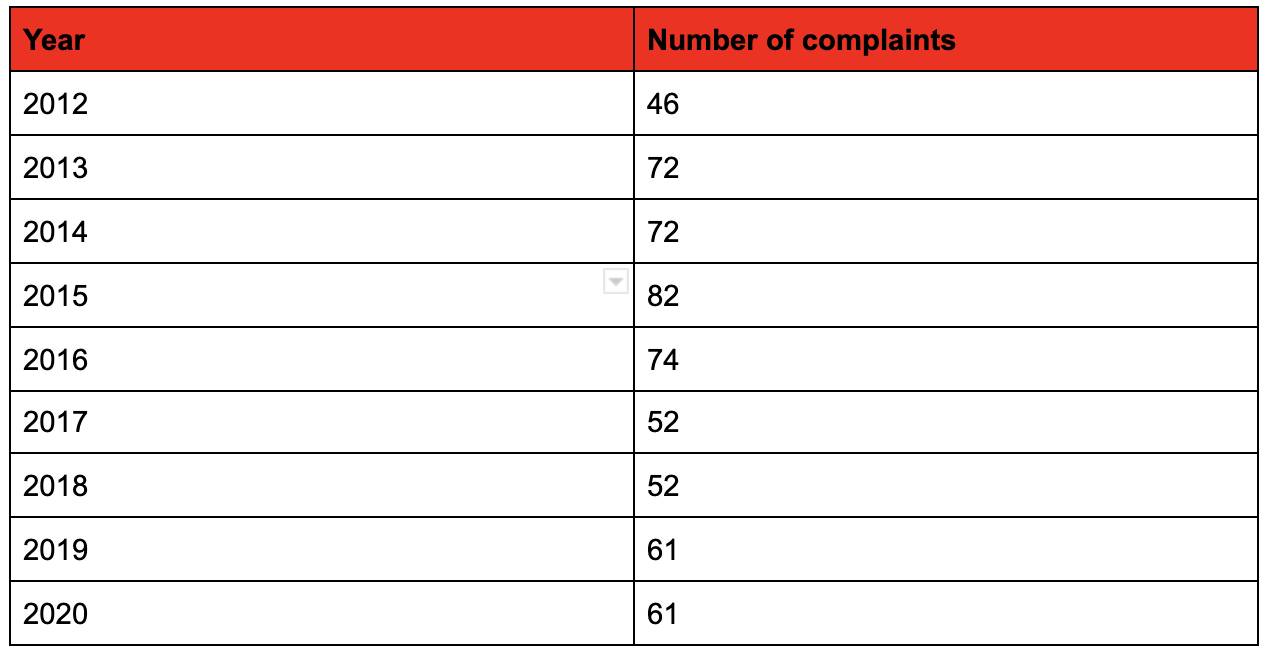

Trading Standards has received 500 complaints against Harrogate district builders or contractors since 2012 — but only 12 prosecutions have taken place.

The Stray Ferret obtained the data from North Yorkshire County Council through a freedom of information request.

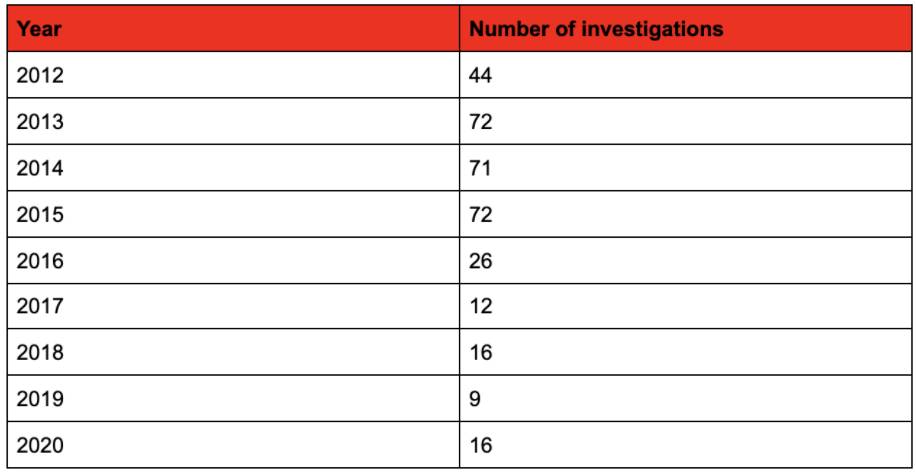

The request also revealed that 338 separate investigations have taken place following the complaints. However, the number of investigations each year has fallen sharply: in 2013 there were 72 and the number fell to just 16 in 2020.

The findings, along with the experiences of some of those who have filed complaints, have led to concerns about the value of taking action.

Jon Fallis, who filed a complaint after Harrogate cowboy builder James Moss left a £30,000 conversion in a poor state, said the figures “were not a surprise at all” and raised questions about the effectiveness of Trading Standards in tackling rogue builders.

Trading Standards, which is run by North Yorkshire County Council, has the power to investigate cases of poor work or allegations of fraud against builders.

Mr Fallis added:

“The numbers fit our experience. They have been difficult and obstructive. There’s no feeling they are on the side of the taxpayer.”

We spoke to another person who was so defeated by his dealings with Trading Standards he didn’t bother making a complaint after being unsatisfied with the quality of another Harrogate builder’s work.

The man, who asked to remain anonymous, called the department a “toothless tiger”.

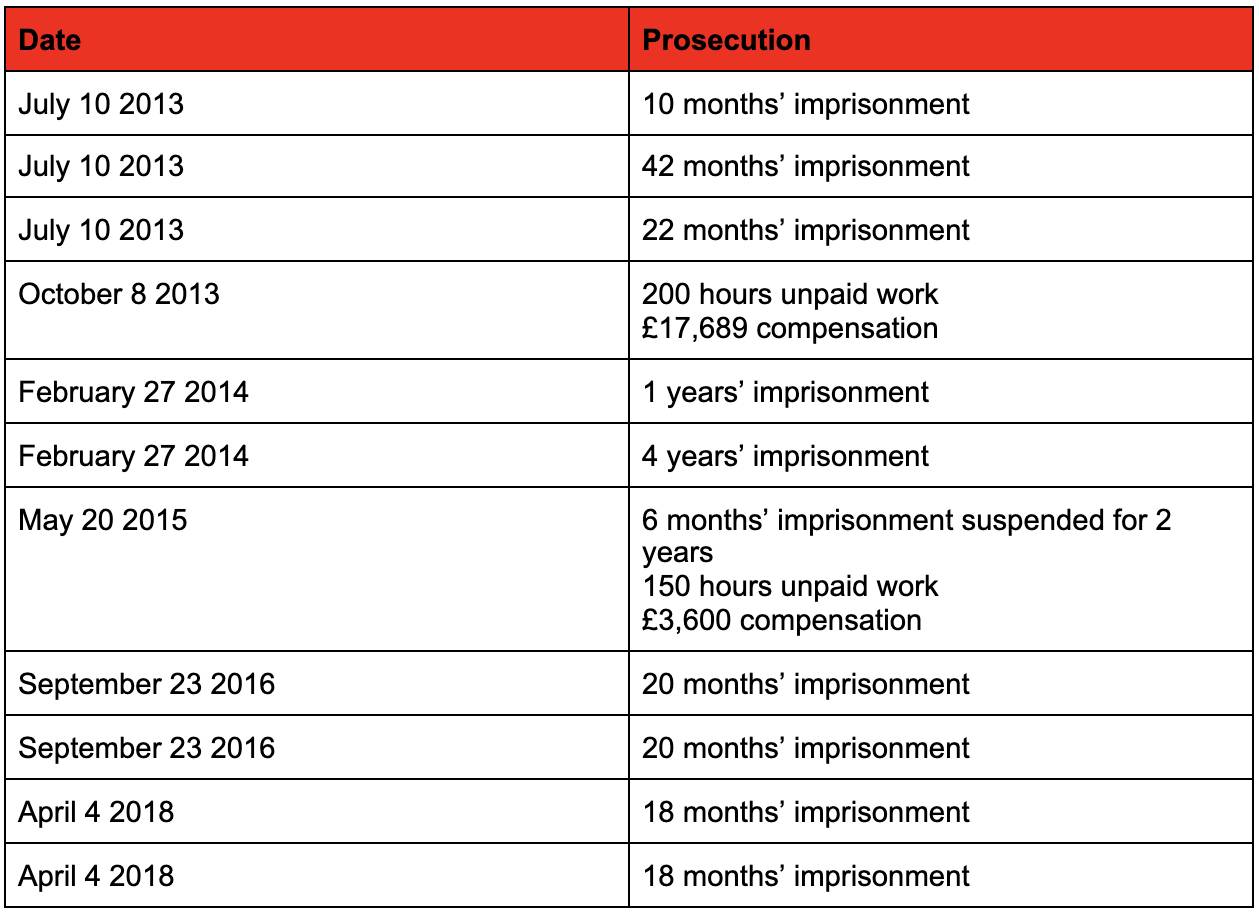

Trading Standards is prevented by law from providing information about individuals or businesses, but its list of prosecutions against builders in Harrogate includes prison sentences, community service and compensation.

The full data is below:

Read more:

- Harrogate cowboy builder James Moss ordered to repay deposit by courts

- Women ripped off by ‘shoddy’ Harrogate builder

The Federation of Master Builders, a trade association for builders, conducted a national survey that found 56% of people who commissioned building work had a bad experience with their builder.

The body has called for the government introduce licensing to stamp out rogue traders.

Trading Standards response

In response to the FOI request, Matt O’Neill, assistant director growth, planning and Trading Standards at North Yorkshire County Council, said:

“Our trading standards service is determined in its enforcement work, not only to protect the residents of North Yorkshire as consumers, but also to ensure a level playing field for the many legitimate businesses in the county.

“The service receives about 7,000 complaints from consumers each year. Officers assess these to determine which should be investigated. Following an investigation, enforcement may range from advice and guidance to prosecution and confiscation or forfeiture of assets following conviction.

“In deciding whether to prosecute, the service must first be satisfied that there is sufficient evidence to provide a realistic prospect of conviction. A decision to prosecute is not taken lightly. Prosecution is a serious step with considerable repercussions for those who face criminal charges.

“The service has a strong track record. For example, a joint operation with colleagues from other agencies last year saw the courts order offenders to give up £140,000 in proceeds from their crimes to compensate their victims.

“There are occasions when the standard of businesses’ work does not meet consumers’ expectations. This is not acceptable and consumers could take action in the civil courts for breach of contract. However, such conduct would not necessarily amount to a practice over which the trading standards service could take action.

“Equally, businesses sometimes fail. This is recognised in law, with provision for the management of bankruptcy and insolvency. A business failure alone will not amount to conduct about which the trading standards service could take action. The Department for Business, Energy and Industrial Strategy has a remit to investigate sole traders and companies that have acted illegally in relation to the formation or solvency of trading entities.”