Subscribe to trusted local news

In a time of both misinformation and too much information, quality journalism is more crucial than ever. By subscribing, you can help us get the story right.

- Subscription costs less than £1 a week with an annual plan.

Already a subscriber? Log in here.

21

Jan

'There's only so much blood you can get from a stone', warns Harrogate bar owner after rates hike

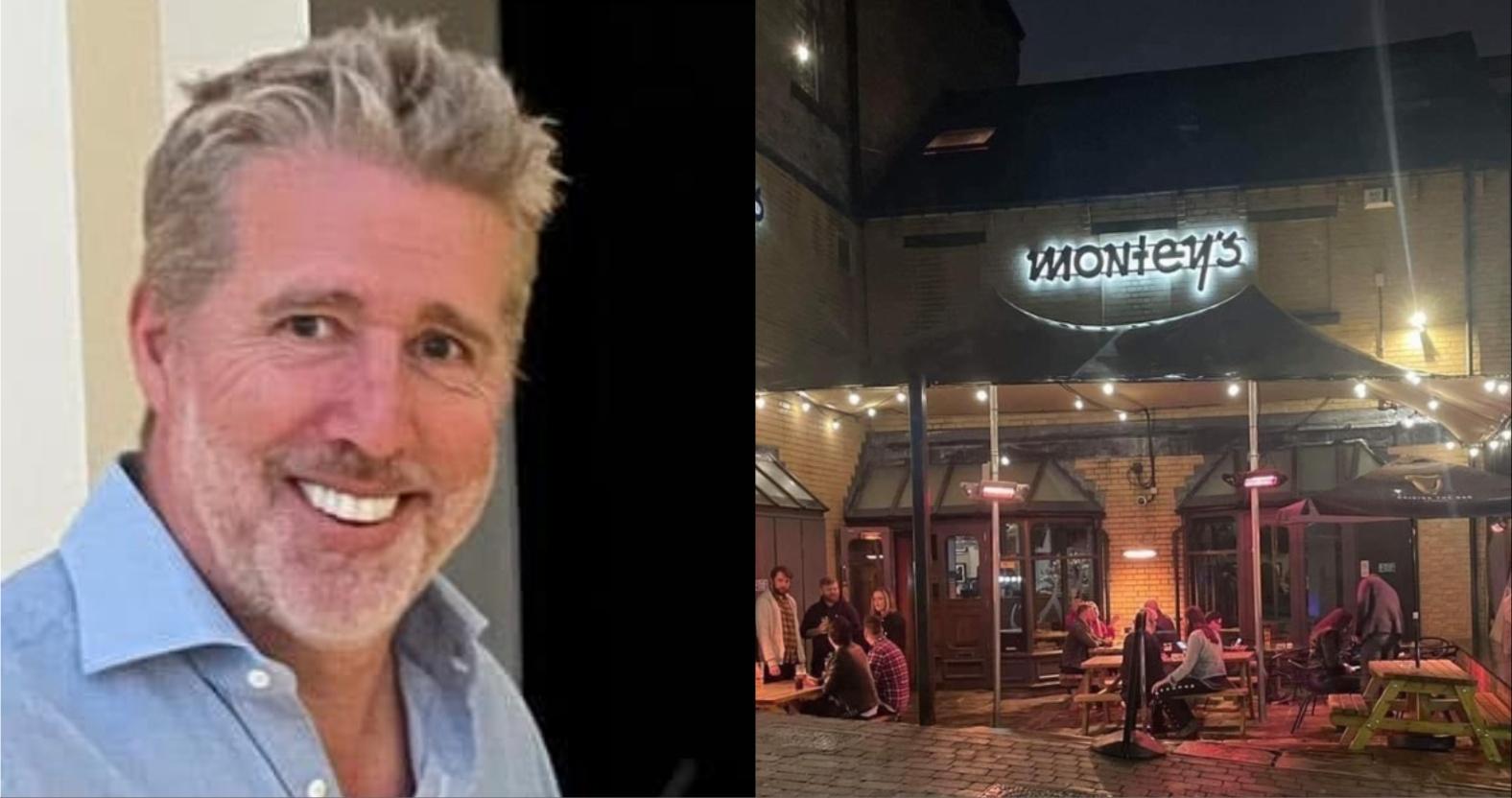

The owner of Harrogate bar Montey’s has taken to Facebook to give a stark illustration of the tough trading environment faced by hospitality venues.

Jay Smith posted a screenshot showing that the rateable value of his bar’s premises will go up from April 1, from £60,000 to £95,000: an increase of nearly 60%.

He accompanied the picture with the simple message “Cheers Rachel, you’re ace…” – a sarcastic reference to the Chancellor of the Exchequer, Rachel Reeves.

Mr Smith's Facebook post.

'Fair, maintainable trade'

The rateable value is determined by the Valuation Office Agency (VOA) and is used to calculate business rates.

In recent years, many businesses have been shielded from rates rises by reliefs that were introduced during the covid pandemic. But now, the government has removed that protection and rateable values for many businesses are set to leap at the beginning of the new financial year in April. The VOA has confirmed that more than 5,000 pubs have seen their rateable values increase by up to 100%.

Mr Smith told the Stray Ferret that part of the problem lay in the fact that rateable values for businesses in hospitality were not calculated in the same way as for those in retail. While other businesses’ rateable values are based on the estimated annual rental value of their premises, those for hospitality businesses are based on ‘fair, maintainable trade’ (FMT), which assesses assumed turnover and profitability.

Mr Smith said:

It’s based on a theoretical idea of what they think you can sustain to give them, not on your real circumstances. The more successful you are, the more vulnerable you are to FMT.

The reason why chefs and pub owners around the country are losing their minds is that they’re being punished for maintaining their position in the market. The VOA seems to say, ‘That guy seems to still be going, so let’s squeeze him a bit more’.

'We've reached a tipping point'

He said the VOA’s calculations were effectively skewed because they did not take into account many of the everyday outgoings that hospitality businesses have to factor in. He said:

The VOA has access to VAT returns and PAYE data. But there are lots of other costs that it doesn’t take into account. They don’t have access to information about our energy costs, or security bills. We pay £1,500 a week for door staff – it's part of the licensing conditions – but they don’t look into that.

They don’t see the interest on bank overdrafts, or covid loans, or unpaid rents, or the bills from cleaners or the fruit man, who comes under the £80,000 VAT threshold.

There’s money walking out the door from the moment we open to the moment we close, but the VOA doesn’t take it into account.

We’ve reached a tipping point, where there’s a disconnect between what they think small, entrepreneurial businesses can withstand and what they actually can withstand.

He said that after the relevant rates multiplier was applied, the new rateable value would result in an annual rates bill for Montey’s of £38,295. He said:

We can appeal it, and we will. But if the appeal doesn’t work, we’ll have to lose a member of staff.

Chancellor of the Exchequer Rachel Reeves.

'Additional support coming'

The Chancellor last week said she was “particularly concerned” about pub business rates, and confirmed that there would be “additional support coming” for pubs before the new rates come into effect in April.

Mr Smith said he would be interested to hear what she had in mind, but added:

I’d be very surprised if she cancelled the new valuations, so my concern is that when she comes back with this support, it will be a temporary relief that will expire at some point.

We’ll be grateful for anything she can do for us, but at some point – when they get bored of giving us that discount – we’ll still be stuck with these new rateable values.

What we really need is an overhaul of the system, which clearly isn’t working. What hospitality is asking for is to be treated the same way as any other business.

There’s only so much blood you can get from a stone.

2