Subscribe to trusted local news

In a time of both misinformation and too much information, quality journalism is more crucial than ever. By subscribing, you can help us get the story right.

- Subscription costs less than £1 a week with an annual plan.

Already a subscriber? Log in here.

21

Sept

Who is in the market to buy Ripley Castle?

When the news broke earlier this month that the Ingilby family had dropped their asking price for the Ripley Castle Estate from £21 million to £13.5 million, jaws dropped across the district.

Slashing your price by so much – 36% – just isn’t normal behaviour for most of us. After all, it would turn a respectable £400,000 three-bed semi into an eye-popping £256,000 bargain.

But then, most of us don’t live in the world of castles and multimillion-pound asking prices.

One person who does, though, is Harrogate-based property consultant Alex Goldstein, and he doesn’t seem at all fazed by the “price correction”.

Mr Goldstein helps clients buy and sell homes in some of the most desirable locations in the country, from Harrogate to Harrow.

He sold a castle just before the covid pandemic hit, and now has another on his books. When it comes to properties like Ripley, he knows the ropes.

He told the Stray Ferret:

Ripley Castle was never going to fly off the shelf. This isn’t a three-bed semi. A couple of years on the market is absolutely standard for this type of property. You’re after a very niche buyer when you’re selling a castle.

Sir Thomas Ingilby.

Property agent Carter Jonas is marketing the Ripley Castle Estate in lots. Lot 1, which includes Ripley Castle, the East Wing events venue, shops, the tearoom, Grindhus coffee shop and the park, now has an asking price of £7.5 million, while the other eight lots remain at their original prices.

Mr Goldstein said:

I agree absolutely with the way they’ve marketed it: test it with the market to see the reaction, and then fine-tune the sale. They’ve just got to keep at it, chipping away at the market until they find their buyer.

But who might the eventual buyer be? Earlier this year, the castle's owner, Sir Thomas Ingilby, told the Stray Ferret he’d be willing to consider “anyone who had the wherewithal”.

Not so long ago, that would have included Russian oligarchs, but they’re out of the running since sanctions struck in the wake of Russia’s illegal invasion of Ukraine.

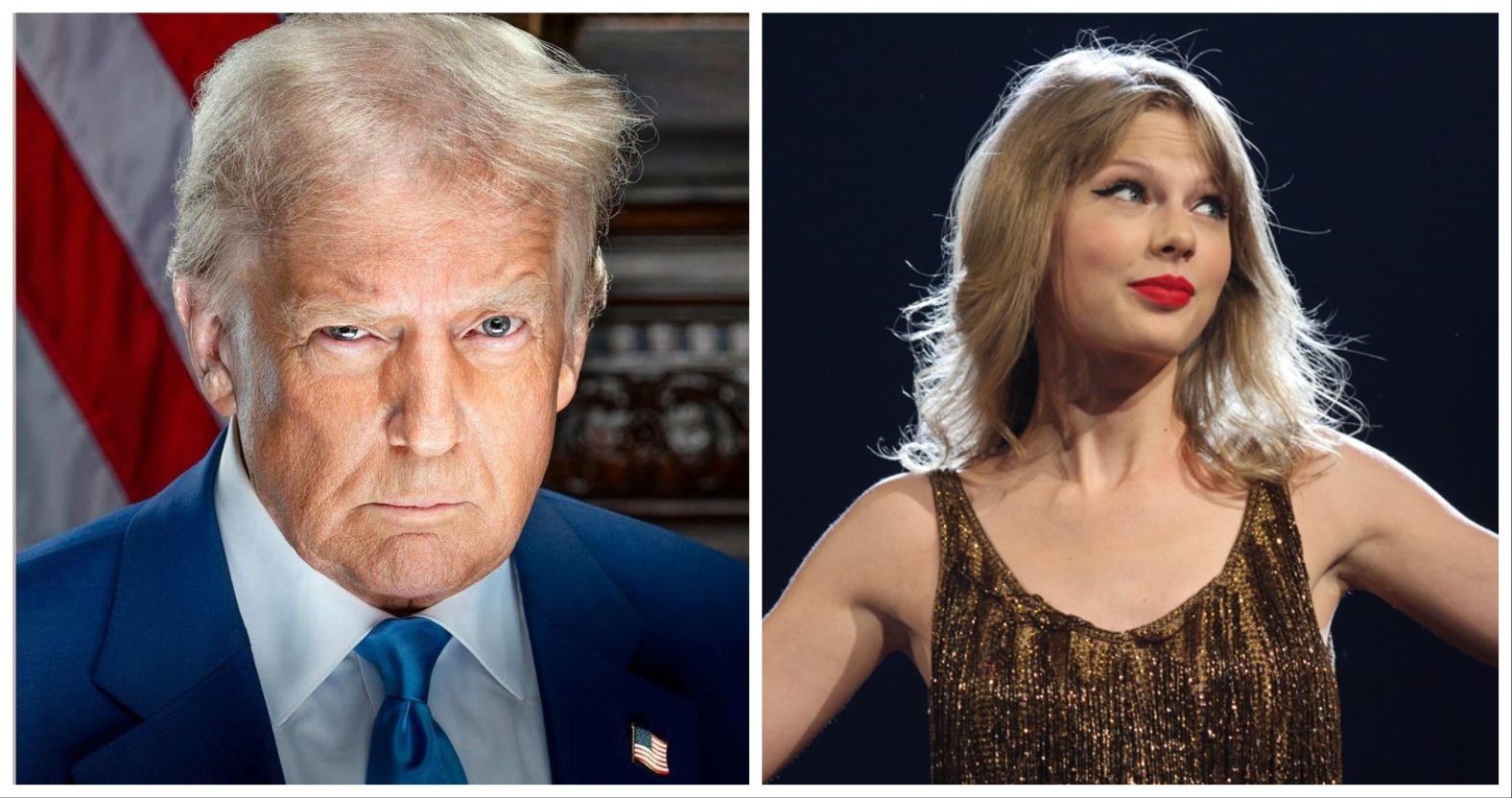

There were rumours last year that Donald Trump and Taylor Swift had shown an interest, but these were quickly quashed by Sir Thomas.

Who would Sir Thomas pick? Photo: Library of Congress & Eva Rinaldi

So who’s left? Well, funnily enough, it could be someone local – but who doesn’t currently live locally.

Mr Goldstein explained:

There are definitely a lot of people moving back from America, largely due to the political situation there, and I’ve also seen a lot coming from the Middle East.

They’ve usually got a connection to the area, and have gone away and made a lot of money, but want to come back home. They often come back because they’re fed up with the international lifestyle, and perhaps have children and want to be near the grandparents or close to certain schools.

There is also a phenomenal number of entrepreneurs from Yorkshire, often in the tech industries, who have gone from zero to hero in the space of a few years and now understandably want to spend some of their wealth on a statement home.

Alternatively, another option is that a commercial operator may come in and turn it into a hotel. Then again, it needs a significant amount of money spending on it, because if you’re going into that market, everything needs to be absolutely on point.

Ripley Castle deer. Photo: Mervin Straughan.

Mark Granger of Carter Jonas confirmed that the firm had fielded interest from abroad. He said:

In the case of the Ripley Castle Estate, we have received many international and UK enquiries; both from commercial operators and from people interested in buying it for their own private use. We are still having discussions with a number of interested parties.

The extraordinary history that is attached to the castle, the beauty of its setting and its location, make it a unique property, and the fact that it could be used for many purposes, from a private house to a commercial enterprise, gives it widespread appeal.

The fact that Russia’s invasion of Ukraine and the political situation in America have already been mentioned highlights one of the problems in trying to second-guess who might buy the estate. The geopolitical lie of the land and the global economy feel far more uncertain than they did just a decade ago, and that has a huge effect on market confidence – people are far less likely to make big purchases or major investments if the future looks unclear.

Mr Granger said:

Because not many castles or stately homes come up for sale, there aren’t market conditions for this type of property on which to comment.

The market/demand for agricultural estates does depend on the location, general amenity, land quality, and what other property is included with the agricultural land.

Furthermore, like all markets, general activity is then affected by financial sentiment – in other words, how prospective buyers view the world and their confidence in what lies ahead.

Clouding the outlook further is the presence of at least four other castles on the market, some of them not too far away, giving potential buyers some choice.

Four castles currently for sale (clockwise from top left): Kirby Knowle, Thirsk, £7m; Appleby Castle, Cumbria, £6.75m; Ayton Castle, Scottish Borders, £3.25m; Bellister Castle, Northumberland, £2.5m.

So predicting who may ultimately take the keys to the castle may be fraught with uncertainty, but Mr Goldstein is nevertheless willing to hazard a guess. He said:

Personally, I feel it will be a private buyer from the international market with a link to the area.

But they may just want the core of the estate – the castle – but not the 160 acres. So I’m afraid it could get carved up, but at least the main entity would be taken care of.

In the meantime, perhaps none of us should hold our breath. The estate was only put up for sale 15 months ago, and, as Mr Goldstein says, at least two years on the market is the norm for a castle. So the Ripley Estate might not be sold before next June, or even later – giving you plenty of time to contact your mortgage adviser.

0